At Techontrek , we are dedicated to delivering unparalleled quality in every product we offer. From trendy clothing to chic accessories, each item is meticulously curated to meet the highest standards of craftsmanship and style. Our commitment to excellence extends beyond our products; it encompasses every aspect of your shopping experience. Whether you're browsing our website or visiting our store, expect nothing but the best in terms of product quality and service.

-

₹129.00

₹129.00- Look beautiful by wearing this gorgeous navy blue colored art silk festive wear designer lehenga for woman designed with all over zari, thread embroidery enhanced by mirror work.

- Accompanied by a heavily embellished art silk choli in similar work and navy blue net dupatta with golden lace details.

- It can be customized up to 42 inches.

-

₹129.00

₹129.00- Get admired by everyone adoring this light green color lehenga in add slub silk material decorated with zari foil work all over the lehenga comes with attached can-can inside.

- This lehenga paired with similar choli material and green rajwadi chanderi silk dupatta with embroidered edge border.

- Lehenga Length: 41 Inch

- Lehenga Flair: 3.15 meter

- Lehenga Type: Semi stitched

- Blouse: 1.00 Meter (unstitched)

- Dupatta: 2.30 Meter

-

₹129.00

₹129.00- Walk on the red carpet like a diva adorning this navy blue color lehenga in net material embellished with all-over sequins work comes with attached inner inside.

- Paired with similar colorfully embellished choli and net dupatta with heavy sequins border work.

- Lehenga Length: 42 inches

- Lehenga Type: Stitched

- Lehenga Flair: 3.50 Meter

- Choli: 1.00 Meter

- Dupatta: 2.25 Meter

-

₹129.00

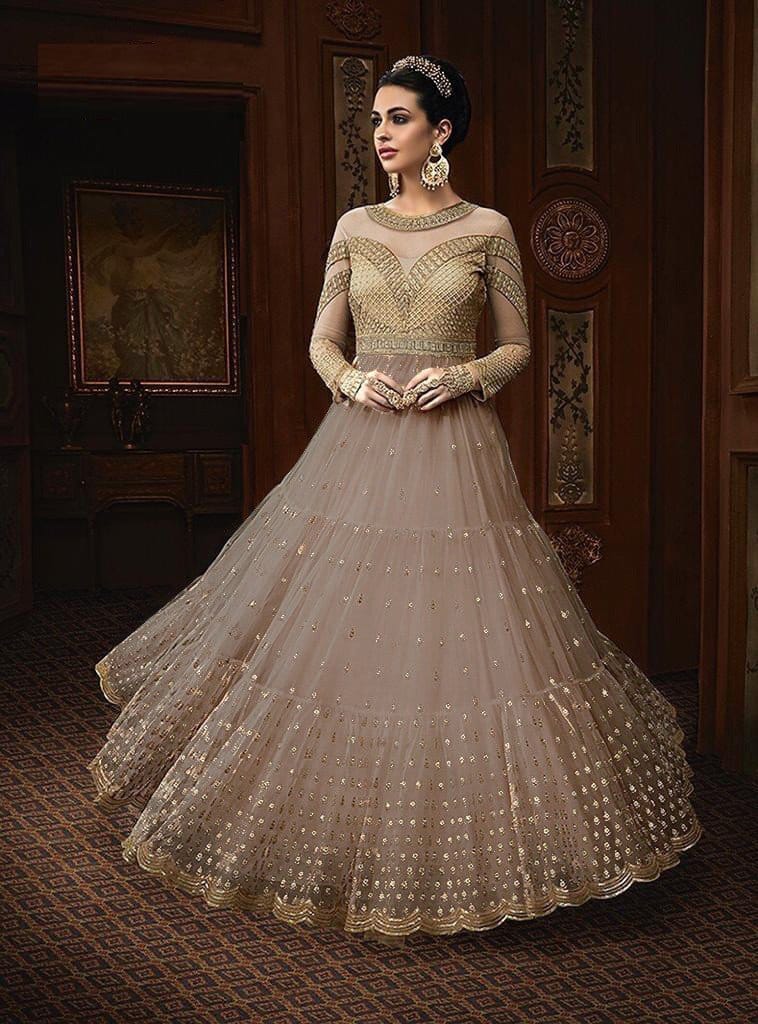

₹129.00- Look glittery beautiful at a party by wearing this flared cream lehenga in soft net embellished with sequins work all overcome with CanCan inside.

- Accompanied by silk sequins work choli and similar net dupatta in soft-net material.

- Lehenga Lenght : 42 inches

- Lehenga Flair: 3.00 Meter

- Choli: 1.00 Meter

- Dupatta: 2.25 Meter

-

₹129.00

₹129.00- Present an energetic highlight to your ethnic attire by donning this lovely peach color lehenga made of net material embellished with thread, diamond work, and dori work.

- This lehenga comes with similar color choli in net material with thread work, dori work, and diamond work has done and peach color net dupatta comes with heavy border thread, diamond and dori work butties all over.

- This lehenga is semi-stitched up to 42 inches comes with fully unstitched choli material, can-can and canvas are also attached.

- Women can buy this gorgeous peach color lehenga choli to wear for their parties, receptions, functions, festivals, wedding functions, engagement ceremonies, and occasions, where you want to be the center of attraction. Team it with traditional accessories to make your looks more beautiful. Buy this lehenga choli and earn lots of compliments from an onlooker.

Best Seller

-

₹79.00

₹79.00Brand Name Bollywood Lehenga Product SKU BL-ZC-8873 Blouse Color Beige Saree Color Beige Saree Fabric Georgette With Embroidery Sequence Work With Ruffle With Resa Work Blouse Fabric Georgette With Embroidery Sequence Work With Ruffle With Resa Work Saree Length : 5.5 Mtr Blouse Size : L,XL, XXL Occasion Wedding &…

-

₹79.00

₹79.00Saree Color Dark Pink Saree ric Heavy Vichitra Silk Saree Work Digital Print With Sequence Embroidery & Gotapati Work Blouse?ric Satin Banglory Blouse?Work Sequence Embroidery & Gotapati Work Saree Length 5.5 Meter Blouse Type 0.80 Meter ?Occasion Ceremony Wear, Party Wear ?Product Care?Instructions Dry Clean Only Advertisement